You probably saw the headlines last week: Misinformation dropped dramatically the week after Twitter banned Trump and some allies OR Misinformation drops 73% after Trump banned from Twitter. Granted, they are powerful headlines but they don't reflect the real story. Sure - mentions of "election fraud" have decreased in recent days, but corporate or financial mis/disinformation only seems to be on the rise.

In 2018 "misinformation" was The Washington Post's Word of the Year, and "disinformation" was NPR's Word of the Year in 2019. Both words were very prevalent in 2020 thanks mostly to the election, polarized politics, a global pandemic, and geopolitical actors. Here we are in 2021. We've got new folks in office, and hopefully we can begin to move past the politics, election narratives, and politicians to focus on something else. So much has been bandied back and forth about the effects of misinformation and “fake news” on politics, campaigns, and elections, but not enough has been discussed about how mis/disinformation can wreak havoc on corporations and organizations.

At a 2019 American Bar Association conference, Former intelligence officer Matthew F. Ferraro quoted a survey that said 88% of investors believed that deepfakes pose a risk to businesses. A fake video of a CEO doing something inappropriate on the eve of an IPO could be catastrophic. For example, in April 2016, a clickbait site posing as TV news published false reports that Coca-Cola’s bottled water brand Dasani was being recalled because of the presence of a parasite in the water that purportedly caused “several hundred” hospitalizations. To add more shock value, the hoax story included an image of a flat and transparent eel larva.

With that in mind, it is important for companies to be prepared and not taken by surprise by a coordinated disinformation campaign. Here at EdgeTheory we've identified three common types of disinformation campaigns targeting corporate America:

Financial Disinformation

These types disinformation campaigns, often called “short and distort”, involve money hungry individuals who spread lies or falsified "facts" about a company, with the intention of knocking down its publicly traded stock.

Individual actors often coordinate their efforts, and use social media, stock-specific forums, and financial blogs to amplify their message.

The TSLAQ community on Twitter is a prime example of financial disinformation. This group uses aggressive tactics in an attempt to uncover and amplify negative news about Tesla and Elon Musk. If TSLAQ succeeded in their mission, would-be investors in Tesla could be scared off, the stock price could plummet, and the TSLAQ members who hold short positions in Tesla would profit.

Activist Campaigns

Activism is another major trend that has attracted malicious actors. These types of disinformation campaigns can be particularly challenging to understand if the actors behind them are hijacking broader legitimate activist campaigns.

Sometimes, companies can even be collateral damage of activist disinformation. In August 2017, for instance, someone on the anonymous online message board 4 Chan said he wanted to inflict pain on a “liberal place” and cooked up a campaign against Starbucks, posting bogus tweets that advertised “Dreamer Day,” when the coffee chain would supposedly give out free drinks to undocumented immigrants. The Seattle-based company had to move quickly to counter seemingly legitimate social media advertisements that carried the hashtag “#borderfreecoffee” and were adorned with the company’s logo, signature font and graphics.

For many companies that are the targets of activism disinformation, the key is understanding what the real narrative is and who is proliferating the false one. Knowing who started the spread of disinformation can help a company understand and counter or participate in the conversation.

Competitive Disinformation

Would a business competitor really take sales and marketing competition to the level of a sophisticated disinformation campaign? You bet. Some big players in the US have been caught bankrolling that kind of activity in the past.

In the above example, businesses started out funding a non-profit, but it soon escalated into funding a disinformation campaign. At first glance the non-profit appeared to be an activist group, but after an investigation it turned out that there was much more to the story.

What can organizations do as disinformation attacks become more common and as deep fakes become more convincing and their use more widespread in both political and business spheres? How can corporations protect their brands and valuations from disinformation? Businesses and institutions should consider the following measures that they can take before, during and after a disinformation campaign:

Listen

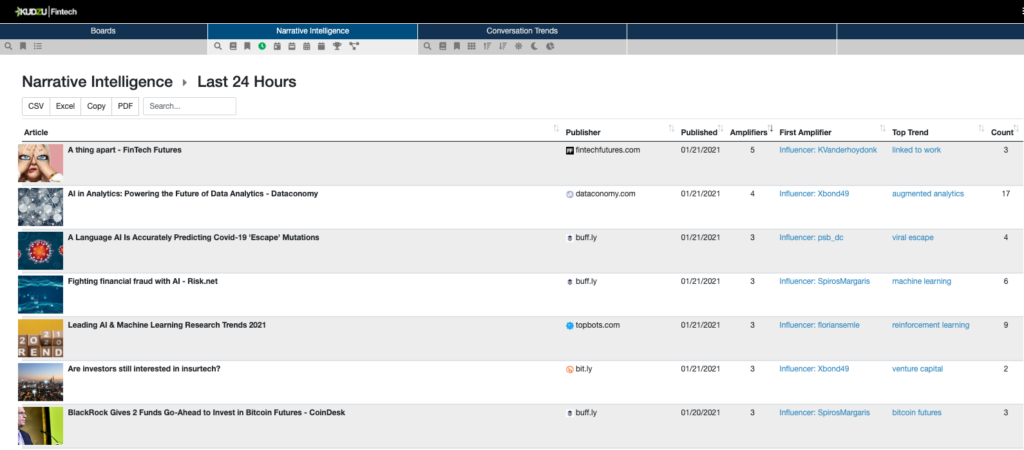

Successful companies understand their markets, their customers and their partners. They also need to understand how their brand is perceived by the media and on social media. By doing so, companies can get advance warning of an individual’s or group’s efforts to spread disinformation about a brand. Kudzu analyzes millions of pieces of content from hundreds of thousands of entities and atomizes the data into Conversation Trends and Narrative Intelligence.

Understand

IPOs, mergers, acquisitions, major investments and product launches can all be inviting targets for disinformation. Consider the phony memo circulated about the Broadcom-CA Technologies acquisition; it was plainly timed for a moment when investors would be most attentive.

Organizations can't put together an effective crisis strategy AFTER bogus tweets start trending. They need to prepare for such events, similar to how they plan for cybersecurity breaches. They have to have the right tools in place. Kudzu provides the ability to group entities by national origin, sphere of influence, political or factional affiliation, industry, or any other organizational unit, in order to better determine the origin and evolution of narrative amplification campaigns. As a result, the platform acts as a force multiplier of analysts, who can see connections and patterns earlier, on larger scales, and on deeper levels than they could previously.

Participate

If an organization is listening properly, it should be able to spot a mis/disinformation campaign early on before it balloons out of control. Understanding the narrative intelligence around an industry or portfolio company is one of the most important assets for any organization or investor. The amplification of the wrong narrative can destroy a business or balance sheet. Kudzu not only detects and monitors the entities involved, it also equips our customers with targeted messaging at scale to harness the power of positive narratives or counter disinformation-filled narratives.

In case you’re still wondering if you’re at reputational risk, consider that disinformation doesn’t have to take the world by storm to have a significant effect. Negative content campaigns have been known to incinerate businesses and permanently harm executive reputations. Even a little bad news, properly promoted, can go a long way, so it’s essential to have plans in place if your company is ever the victim of a disinformation campaign.

Want to learn more about how to protect your organization or portfolio from disinformation? Let us walk you through how we're helping organizations prepare and defend against disinformation. We can also discuss solutions tailored to fit your needs. Contact us before it's too late.