Conversation moves markets. News coverage, social media, and online forums feed off each other. That feeding frenzy can have massive impacts on companies, stocks, and investors. Whether it’s competitors, biased media, foreign adversaries, or homegrown agitators, knowing who’s creating and who’s sharing a narrative can make all the difference.

In the case of Elizabeth Holmes and Theranos, a little narrative intelligence could have saved investors and analysts from impending disaster and the loss of lots of money.

Here's an Elizabeth Holmes refresher:

In 2003 at the age of 19, Holmes dropped out of Stanford and founded Theranos on an idea for a drug-delivery patch that could adjust the dosage to suit an individual patient's blood type and then update doctors wirelessly.

The patch never made it to market, but the big idea - the one upon which the whole hoopla of Theranos was built - was a machine that could test for a variety of diseases through only a few drops of blood from a person's finger.

Powerful people were enthralled and invested without seeing audited financial accounts.

Henry Kissinger, Rupert Murdoch, US Treasury Secretary George Schultz, decorated Marine Corps general James Mattis, and America's richest family, the Waltons, were among her backers.

There was just one problem: it didn't work.

A story in the Wall Street Journal in 2015, accusing the firm of not using its own machines to test blood samples, prompted an investigation by the US financial regulator, the Securities and Exchange Commission.

Within a year, Theranos had its licenses revoked and began shutting down its labs.

Forbes magazine revised Ms. Holmes' wealth down from $4.5bn to "nothing".

Today jury selection begins in the Elizabeth Holmes Theranos fraud trial. Opening statements are slated for Sept. 8 and the trial is expected to last for weeks. Holmes and her ex-boyfriend Ramesh Sunny Balwani, former Theranos COO, are now charged with ten counts of wire fraud and two counts of conspiracy.

So how would narrative intelligence have helped Theranos investors? To give a little perspective: the first iPhone was released in 2007, Twitter wasn't founded until 2006, Reddit wasn't a thing, and most people still got their news from newspapers and television. People weren't constantly plugged into the world via the internet and smartphones. Today understanding the conversations happening online has never been more important.

Conversation can be your biggest asset or if used incorrectly or misunderstood, your greatest liability. Conversation wins business, elections, and wars. EdgeTheory products and systems help our customers understand conversations in complex social ecosystems.

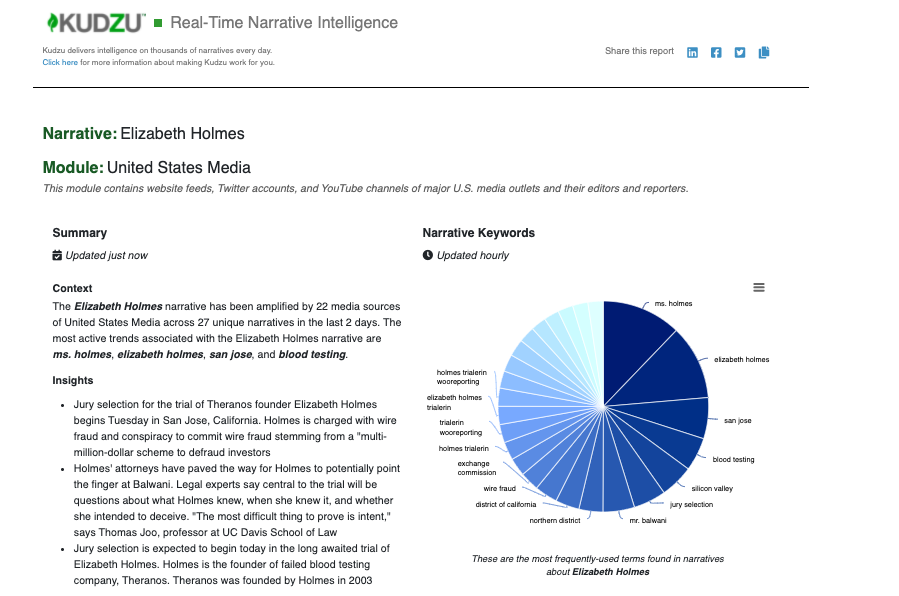

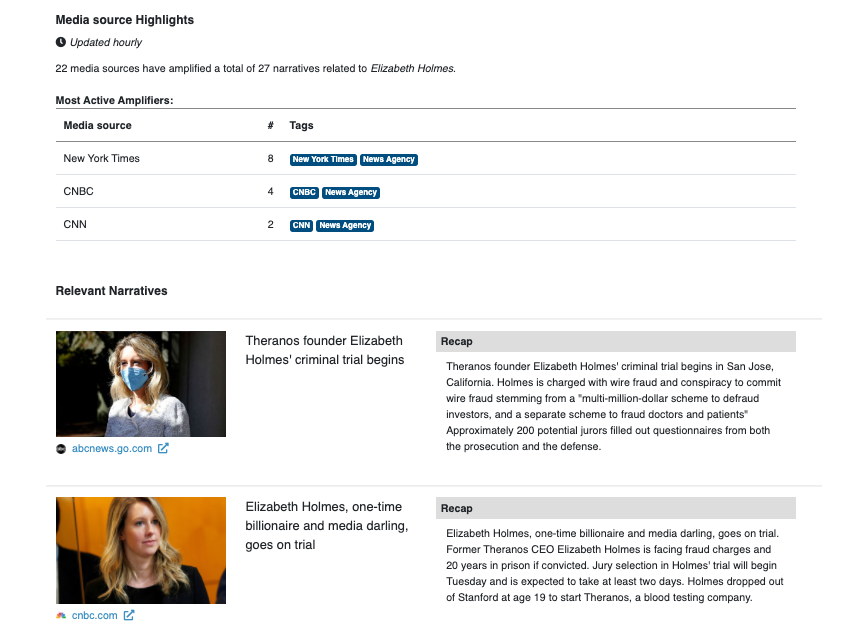

To understand the conversation, our product Kudzu consumes large amounts of publicly available information (PAI). Kudzu delivers rich narrative intelligence that includes conversation trends and narrative amplification detection. Customers can see what’s being talked about, who’s doing the talking, and how networks of influencers are amplifying narratives.

Two key features of Kudzu are:

Would you like an unbiased view of the conversations that shape your world? Reach out for a free demo.