The global race for artificial intelligence supremacy has evolved into a high-stakes contest over semiconductor manufacturing, infrastructure development, and national security. The United States projects leadership through export controls, strategic alliances, and industry incentives —expressed in its AI Action Plan. It prioritizes chokepoint control across semiconductor supply chains and compute infrastructure. US narratives have intensified around Taiwan’s centrality to this strategy, portraying it as both an irreplaceable asset and a structural risk. Taiwan’s semiconductor dominance—led by TSMC—is increasingly strained by a 34,000-worker shortage, demographic decline, and geopolitical vulnerability, making it a focal point in discussions about reshoring production and safeguarding technological sovereignty.

Meanwhile, Global Cognitive Adversaries (GCA) sources counter this narrative by framing US trade and tech diplomacy as coercive and destabilizing, particularly in the Global South. China's positioning contrasts sharply—amplifying themes of multilateralism, state-backed infrastructure, and open-source collaboration through BRICS and the Global Development Initiative. Beijing has leveraged recent media amplification around Taiwan to signal its own ascendancy, with the Taiwan Affairs Office predicting the mainland will surpass Taiwan in mature-node chip production within two years. This narrative architecture paints China as an inclusive alternative to US dominance, while undermining Taiwan’s long-term viability as a strategic partner.

Amid this contest, regional powers are carving independent pathways. India’s Semiconductor Mission and digital infrastructure push reflect a broader bid to internalize critical capabilities. Europe remains regulation-forward, championing AI ethics and data privacy, yet is hampered by institutional fragmentation. The Middle East is emerging as a battleground of influence, where Trump’s 2025 AI diplomacy competes with China’s sovereign cloud and infrastructure financing. Across these domains, GCA narratives amplify perceptions of US hegemony, European irrelevance, and Chinese partnership—contributing to a distributed, multipolar competition over digital legitimacy rather than outright technological dominance.

Sourcing amplifications from EdgeTheory NARINT brief

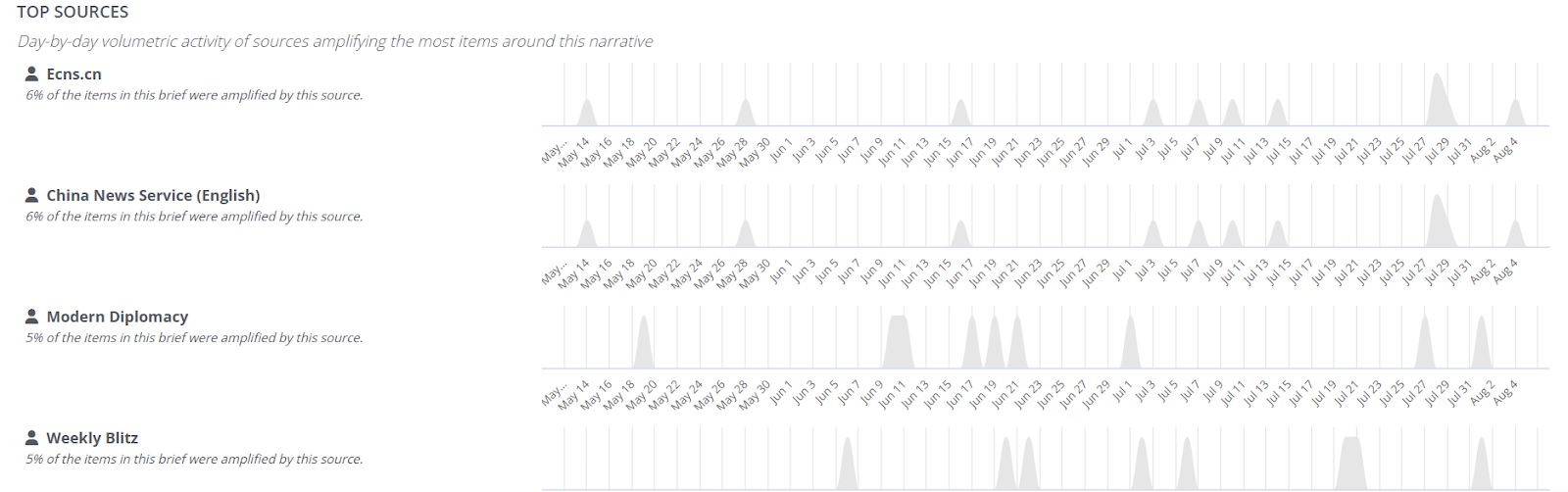

The amplification timeline for the global AI competition narrative demonstrates sustained engagement across 91 sources which began growing from May–August 2025. These sources began as sparse articles and increased amplification across Facebook, Weibo, and X, reflecting a strategically coordinated media effort. Ecns.cn one of the most pivotal sources and amplifiers of Chinese narratives leads with a consistent share of amplification, exhibiting steady peaks in mid-June and late July that signal a persistent narrative push aimed at reinforcing China’s positioning. China News Service mirrors this pattern with equivalent volume, but its impact is amplified by its international syndication reach and English-language distribution, which extend the narrative beyond domestic Chinese audiences. Peaks in early June and mid-July suggest deliberate synchronization designed to shape external perceptions of China’s cooperative AI posture. Modern Diplomacy and Weekly Blitz each account for 5% of amplification, with Modern Diplomacy active in late May and early August and Weekly Blitz peaking sharply in mid-July, indicating varied editorial timing aligned with evolving geopolitical and technological developments. Collectively, these amplification dynamics highlight an intensified and multi-faceted contest over AI and semiconductor discourse, shaped by both regional interests and broader geopolitical contestation.

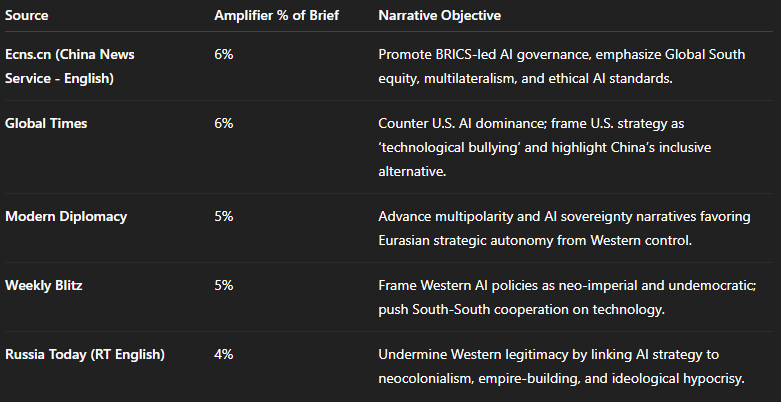

Summary of narrative strategies from ChatGPT categorizing most amplified sources in EdgeTheory briefs

Five primary sources are responsible for 26% of the total narrative amplification across the 91 sources tracked. Content includes official BRICS statements on AI ethics, editorials framing US export controls as self-defeating, and commentary highlighting shifts in AI infrastructure investment. Each source published multiple narrative items between May and July 2025, with geographic origins concentrated in Beijing, Moscow, and affiliated media hubs. Coverage overlaps with key diplomatic events including the BRICS AI statement release and the US AI Action Plan announcement.

Amplified narratives emphasize why multilateral AI coordination is necessary, trying to delegitimize US AI leadership, and framing US policy as coercive or imperial. Messaging from these sources underscores themes such as digital sovereignty, strategic decoupling from US technology supply chains, and the promotion of open-source AI alternatives positioned as inclusive and non-aligned. Multiple items highlight disparities in access to AI infrastructure, casting China’s model as cooperative versus the US model as extractive. These narratives largely originate from GCA or GCA Social Media sources that seek to slant narratives in their favor to influence the global marketplace. Narrative volume peaks coincide with major geopolitical declarations or executive orders related to AI, indicating synchronization between source output and policy signals.

Distribution of Key Actors Mischaracterizing AI Narratives

The chart shows that 48.1% of narrative content in the brief is aligned with Chinese AI hegemony narratives. Russian alignment accounts for 27.1%, followed by India at 9.4%, Europe at 6.1%, the Middle East at 5.5%, and Gaza at 1.7%. All figures represent the proportion of total narrative items attributed to geographic or ideological alignment categories tracked within the Global Cognitive Adversaries module. This distribution provides the baseline against which foreign response narratives to the White House AI Action Plan—particularly those addressing AI and microchip competition on the global stage—can be measured.

Sourcing from NARINT brief

Sourcing from Gaza originates from The Egypt Independent which speaks on export controls and easing international tensions between China and the US.

Global Cognitive Adversaries (GCA) narratives frame the White House AI Action Plan as a pivot toward deregulated technological dominance. Across 14 unique sources amplifying 21 narrative items, messaging focuses on US efforts to prioritize infrastructure expansion, reduce regulatory friction, and assert leadership in the global AI economy. These narratives identify the Trump administration’s policy as protectionist, economically motivated, and structured to stifle Chinese technological growth. Amplifiers describe an alignment between US industrial interests and federal initiatives, emphasizing datacenter construction, AI export acceleration, and politically neutral AI development.

Narratives consistently characterize the US plan as a containment mechanism targeting China’s AI and semiconductor sectors. Multiple sources refer to “technological bullying,” positioning the US approach as ideologically driven and structurally aggressive. The Sri Lanka Guardian and Azerbaijani Press Agency point to contradictions in enforcement, suggesting gaps in interagency coordination and possible leakage of chip technology. This narrative cluster establishes the foundation for an expanding narrative warfare environment centered on AI and microchip infrastructure.

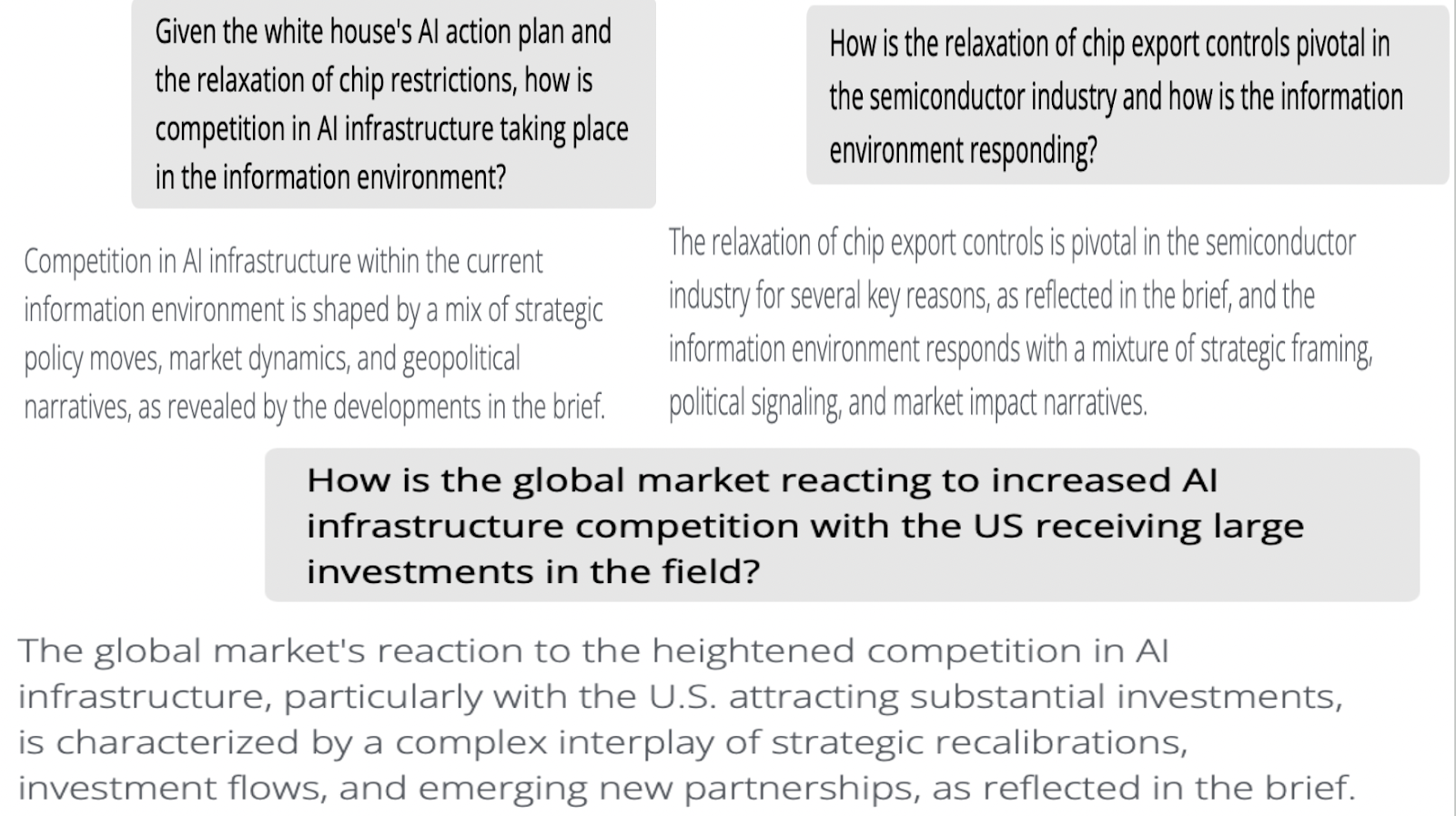

EdgeAgent from NARINT brief providing context for AI-Microchip Competition

EdgeAgent highlights a measurable intensification of AI infrastructure competition catalyzed by the White House AI Action Plan and the relaxation of chip export controls. Its analysis outlines the US government's removal of regulatory barriers and acceleration of data center and semiconductor fab construction, reflecting policy-driven infrastructure expansion. EdgeAgent identifies private sector alignment through large-scale investment examples like the "Stargate" project, consistent with narrative items from China US Focus and Azerbaijani Press Agency, both of which detail infrastructure-led growth and the reconfiguration of AI export policy as a strategic lever.

X profile Chenghao Sun post on China-US Competition highlighting Trump administration role in AI war

The June 20, 2025, China Scholar Insights drop amplifies the U.S.–China AI race as the core battleground of global power, framing DeepSeek’s breakthrough and Washington’s May policy pivots—loosening some chip restrictions while tightening Huawei clamps—as competing signals in a high-stakes narrative war. Voices like Xiao Qian push a cooperation storyline against a hardening trust deficit, while other academics believe that the U.S. share of R & D is collapsing and China is scaling toward a trillion-yuan AI economy by 2030. Layered across this is GCA amplification from outlets like Pravda, recording U.S. controls as coercive and China’s model as multilateral—embedding the multipolar governance frame into the architecture of AI geopolitics.

X profile Saleh Al Mirzim post on Saudi Arabia-US Agreements on AI & Infrastructure

President Trump’s 2025 state visit to Saudi Arabia marked a high-profile pivot in America’s AI strategy, fusing tech diplomacy with geopolitical counter-influence. Accompanied by Silicon Valley CEOs, Trump brokered landmark AI chip and infrastructure deals with Gulf states, particularly the UAE and Saudi Arabia. These agreements—including the mass export of NVIDIA GPUs and the development of one of the world’s largest data centers in Abu Dhabi—reveal a calculated US effort to flood the Middle East with American AI capacity. The move is not just about market access—it’s about narrative dominance: shifting the perception of the Gulf from a Chinese tech zone to a battleground of Western-aligned AI modernization. However, GCA-linked sources across the Middle East have characterized the visit as neo-digital colonialism, framing the US presence as an attempt to subvert regional digital sovereignty and impose a Silicon Valley-controlled architecture under the guise of cooperation. While critics argue the strategy offshores US. innovation, Trump’s doctrine reframes globalization as a projection of American technological sovereignty, using partner nations as staging grounds in a digital Cold War.

This initiative directly challenges China’s years-long effort to entrench itself in the Middle East’s digital and energy transition ecosystems. Trump’s AI expansion acts as a dual-function narrative weapon—disrupting Chinese strategic positioning while solidifying the US as the preferred AI partner. The absence of direct regional backlash suggests tacit Gulf alignment or transactional pragmatism.

Over the past 30 days, 131 GCA-linked sources pushed 677 narratives on AI governance, semiconductor policy, and global tech competition, highlighting key developments like France’s 2025 AI Action Summit and India’s Semicon India initiative. Among the most significant amplifiers, Vz.ru framed Russia’s AI strategy as a sovereignty defense against “neocolonial AI-lism,” while TechWireAsia escalated the Taiwan semiconductor narrative by spotlighting its blacklist of Huawei, SMIC, and nearly 600 entities—signaling hardening ideological lines in global supply chains. These narratives break from a U.S.-China binary, signaling a multipolar race where Europe, South Asia, and West Asia assert sovereignty through alternative governance models, regional partnerships, and infrastructure strategies for next-gen AI and chips.

France amplifies “gouvernance mondiale de l’IA,” positioning itself as a multilateral broker, while the Netherlands advances “open strategische autonomie” to maintain openness without strategic dependency. India’s Semicon India initiative stands out as a major inflection point, channeling massive investments into chip design, fabrication, and AI hubs to claim global leadership. Collectively, these narratives not only challenge the US-China duopoly but position multipolar governance and strategic autonomy as central frames in the emerging tech order.

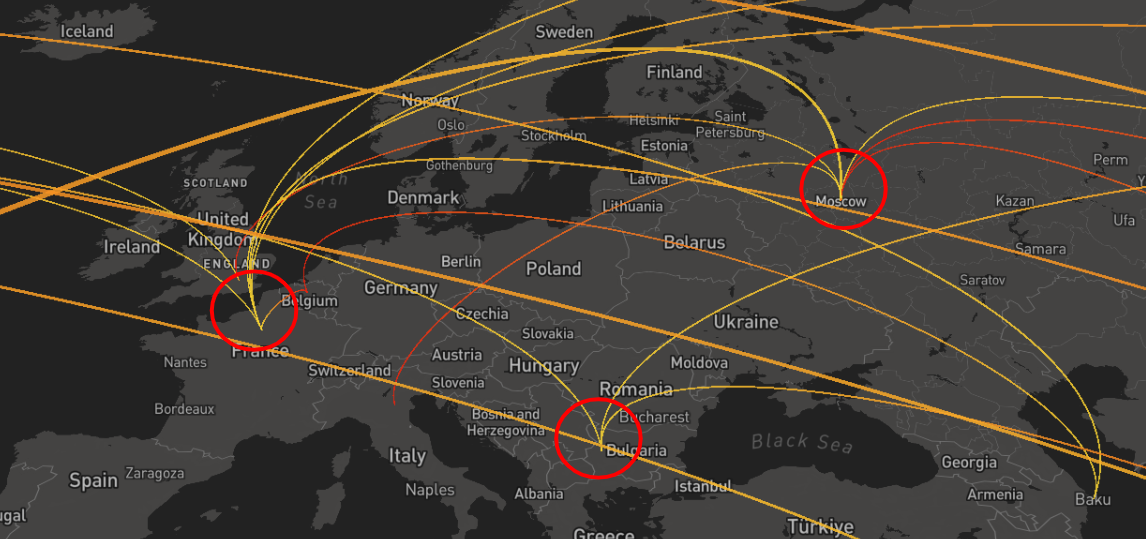

Geospatial Diffusion of Narratives from the EdgeTheory Brief

Key origins of GCA narratives in Europe are Paris, Sofia, and Moscow. There are no clear destinations that emerge in Europe, though Moscow is the primary origin for narratives contained within Europe. The narratives coming from Paris primarily focus on international cooperation and AI governance. At the 2025 World Artificial Intelligence Conference (WAIC) and related forums, the French president’s AI envoy emphasized the urgent need for global action toward openness, accessibility, inclusiveness, and establishing a strong global governance framework for AI. Additionally, narratives stemming from Paris mention collaboration between Chinese AI firms and French multinational Schneider Electric in showcasing industrial AI applications at the WAIC. GCA narratives discussing the collaboration emphasize the inclusive innovation and international partnership between France and China.

Screenshot of EdgeAgent UI

The global AI race reflects a rapidly shifting balance of technological power, where national strategies, regulatory ideologies, and market dynamics compete for long-term influence. According to =EdgeAgent, “The US continues to lead in AI research, advanced chip manufacturing, and capital investment,” with core contributions from major firms like Nvidia, Microsoft, OpenAI, Google, and Meta. Under the Trump administration, Washington has implemented “aggressive AI policies [that] aim to spur innovation, accelerate infrastructure buildout (data centers, energy grids), and maintain global technological dominance.” Export controls are being used not only to “restrict Chinese access to key technologies” but also to reinforce US influence over global AI platforms. These efforts are complemented by investments in STEM education, AI talent development, and the cultivation of “open innovation ecosystems” that strengthen transnational partnerships with like-minded states.

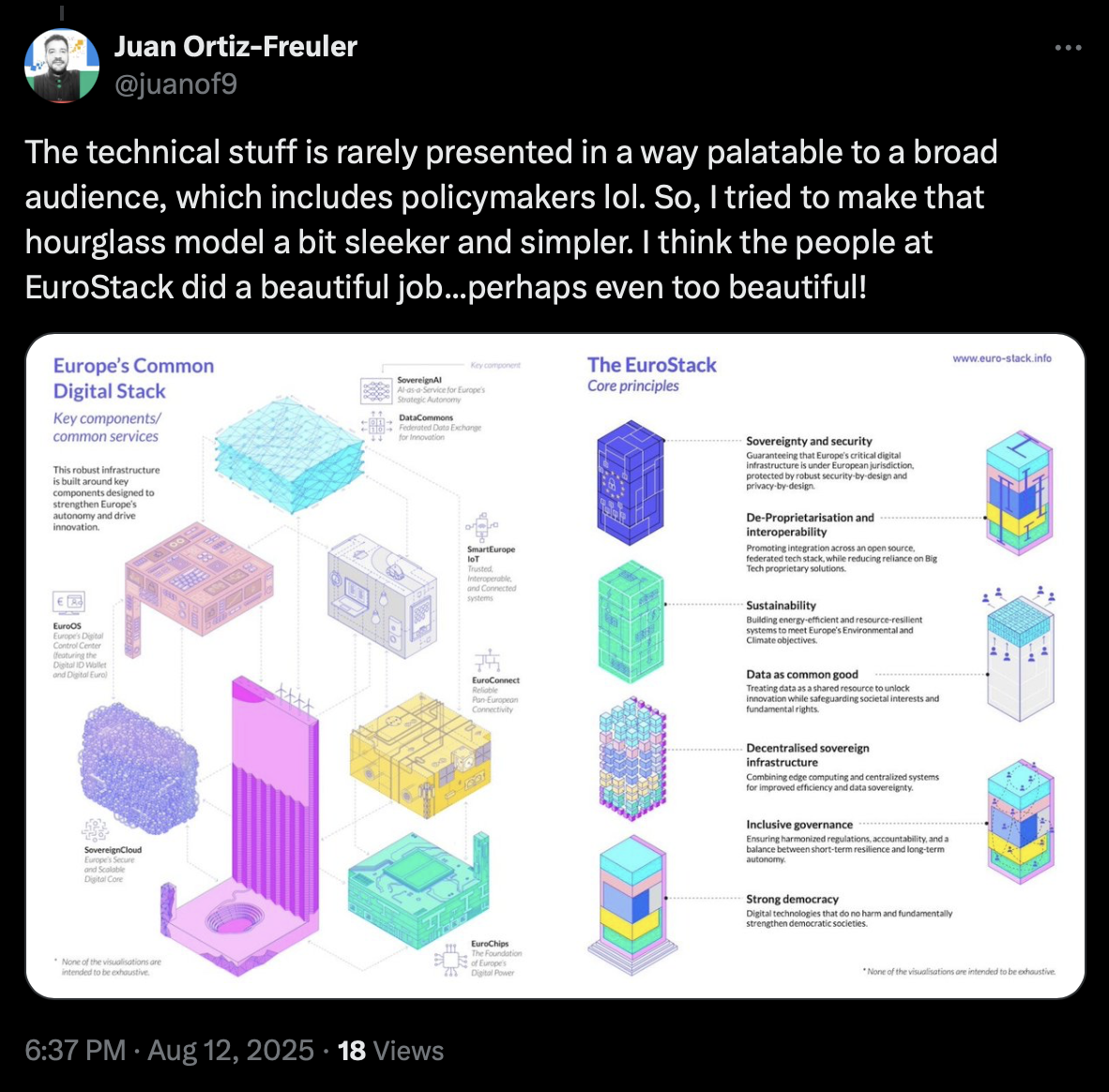

X profile Juan Ortiz-Freuler post on Eurostack digital sovereignty

On August 12, 2025, @juanof9 commentary amplified the EuroStack narrative as more than just a technical project—it’s a strategic play for European digital sovereignty. By deploying simplified internet stack diagrams for policymakers, the initiative reframes complex infrastructure into an accessible visual language, creating clarity where opacity once dominated. This isn’t just education; it’s narrative engineering—positioning EuroStack as the scaffolding for a future where Europe breaks free from systemic reliance on U.S. and Chinese tech ecosystems. Backed by a projected €300 billion, decade-long investment, EuroStack signals Europe’s intent to rewrite the rules of global connectivity and assert itself as a third digital pole in a bipolar tech order.

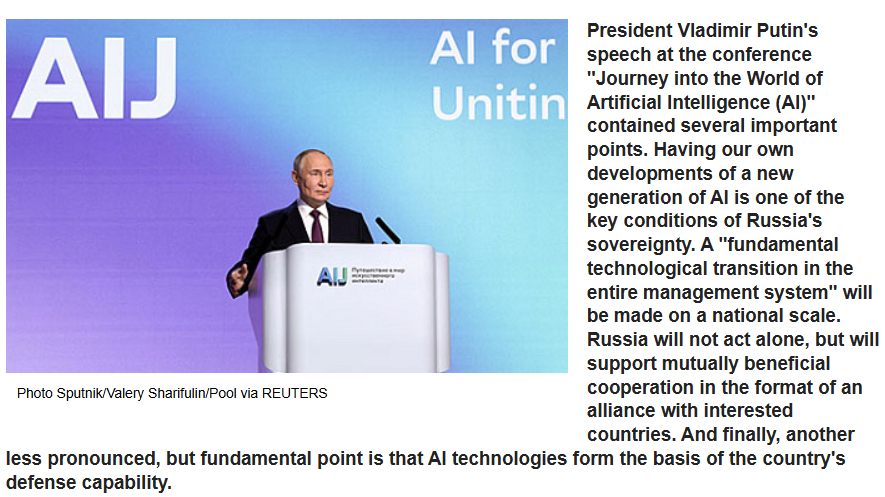

Article from Vz.ru translated into English on Putin’s speech about AI transforming tech & defense sectors in Russia

Russia and Eurasia remain primarily focused on defensive AI strategies and sovereignty preservation, citing threats of “neocolonial AI-lism,” while Australia, a lower-profile actor, aligns with US frameworks but struggles with “limited local AI talent” and innovation scale.

As EdgeAgent concludes, “this dynamic creates a multipolar landscape where AI development and governance are deeply entangled with geopolitics, economic strategy, and global cooperation challenges.” While the US retains a lead in frontier innovation and platform control, China is rapidly closing the gap, and other regions are crafting region-specific models that could disrupt centralized influence. The AI race is no longer just about technological advancement—it is a contest over who shapes the future digital order.

X profile The Emissary on the semiconductor revolution

India is increasingly positioning itself as a critical player in the global semiconductor, AI, and microchip competition. Through a substantial investment of ₹76,000 crore under the Semiconductor Mission, India aims to transition from primarily chip design capabilities to establishing a robust manufacturing base. This strategic shift is designed to secure a significant place for India within the global chip value chain. By leveraging its top-tier design talent and fostering an ecosystem that supports both innovation and production, India is not only enhancing its technological sovereignty but also aiming to become a pivotal node in the semiconductor revolution. This development underscores India's ambition to contribute meaningfully to the international race for advanced AI and microchip technologies, diversifying the global supply landscape beyond the traditional US, China, and Taiwan-centric dominance.

X profile Niels Groeneveld on AI & Microchip Global Competition

The tweet from @nijgroeneveld, posted from the Netherlands, amplifies a European narrative on global power realignment titled “The New Cold War: How the US, Russia, and China Are Redrawing the World Map,” asserting that the world is entering a multipolar confrontation driven by the US, China, and Russia. It frames the new contest as a complex struggle where military strength, economic influence, and technological dominance are primary battlegrounds, rejecting Cold War analogies grounded in bipolarity. The tweet highlights shifting alliances, redrawn trade routes, and hardening spheres of influence, signaling structural disruption in post-Cold War norms and reinforcing European concerns about strategic fragmentation. Military capability is only one vector of power alongside economic leverage and technological supremacy, reflecting a geopolitical model governed by distributed and contested influence zones. Emphasizing tensions across Europe, the post conveys apprehension over Russia’s actions, particularly in Ukraine, which threaten EU stability and challenge transatlantic security frameworks. The commentary underscores Europe’s need to navigate competing powers, protect economic interests, and adapt to a multipolar world where the reordering of the international system directly impacts security, trade, and alliance structures.

techwireasia article on Taiwan semiconductor and microchip export controls

Taiwan’s blacklisting of Huawei, SMIC, and nearly 600 other entities escalates the global microchip and AI competition narrative, locking the island into U.S.-led export control regimes that recast semiconductors as strategic weapons in a tech cold war. By grouping China’s top chipmakers with sanctioned actors from Russia and Iran, the move amplifies the frame that access to advanced chips defines geopolitical power, while Taiwan—home to TSMC—emerges as a core amplifier of the techno-democratic containment architecture. This shift from trade pragmatism to security signaling hardens supply chains along ideological lines, reinforcing GCA narratives that paint China’s AI ambitions as destabilizing and illegitimate.

The global contest over artificial intelligence and semiconductor supremacy is reshaping the foundations of international power. The United States maintains a lead through capital investment, export controls, and a concentration of advanced research capabilities. However, its innovation ecosystem remains fragmented, with declining public R&D spending and institutional misalignment weakening long-term strategic coherence. China offers a cohesive, state-led alternative that combines industrial policy, international outreach, and narrative framing. It continues to expand its influence across the Global South and the Middle East by providing infrastructure without political conditions and promoting an inclusive technological vision. Yet the contest has moved beyond a binary rivalry. India, Europe, and the Middle East now act as autonomous centers of technological development, introducing complexity that prevents any single power from dictating global standards.

Global Cognitive Adversaries (GCA) campaigns exploit regional tensions, reframing US actions as coercive, European policies as ineffective, and China’s strategy as equitable and collaborative. These narratives shape global perceptions of legitimacy, fairness, and digital trust. In this contested space, the ability to offer interoperable, secure, and inclusive governance models will determine influence. India leverages its digital public infrastructure and non-aligned posture to promote a hybrid approach. Europe emphasizes ethical regulation but continues to struggle with implementation and scale. The Middle East, once viewed solely as a battleground, is now asserting itself as a strategic actor capable of shaping outcomes. As this race accelerates, the emerging global order will be defined not by dominance but by distributed influence—determined by those who can align technological capability with credible governance and trusted narratives.