Synopsis

In this Kudzu Narrative Intelligence Brief, the narrative of the U.S. debt ceiling is being driven by 439 sources across 2,661 narrative items, with the Washington Examiner leading the narrative amplification. The situation involves an impasse between President Biden and House Speaker Kevin McCarthy, threatening a first-ever U.S. default if the debt limit isn't raised or suspended. This comes against the backdrop of emergency legislation enacted during the COVID-19 pandemic, which allowed participants in the Supplemental Nutrition Assistance Program (SNAP) to receive maximum monthly benefits regardless of income.

Rolling Updates

This Kudzu Narrative Intelligence brief auto-updates every few hours with fresh analysis on the debt ceiling crisis:

Key Themes:

- SNAP benefits

- The debt ceiling

- Emergency legislation

- Work requirements

- Risk of default

Key Developments:

- Nearly two dozen House Republicans have co-sponsored legislation imposing stricter work requirements for able-bodied adults without dependents.

- Senate Budget Committee Chairman Sheldon Whitehouse suggested using the 14th Amendment to raise the debt limit, claiming Biden has the authority under the Constitution to do so without Congress. However, this suggestion has faced opposition from Republicans in both the House and Senate.

Significance

The debt ceiling impasse presents a critical risk to the U.S. economy, with a potential default looming. This crisis brings to light the political maneuvers behind crucial economic decisions and their potential implications on the welfare of American citizens.

Key Points:

- The impasse over the debt limit between President Biden and House Speaker Kevin McCarthy poses the risk of the first-ever U.S. default, which could have catastrophic implications for the global economy.

- The ongoing crisis has raised constitutional questions regarding the power to borrow money and the potential to default on such borrowing.

- The discourse around SNAP benefits and work requirements highlights the political tension around social security programs in the context of economic recovery from the pandemic.

Timeline of Events

- Early 2020: Congress enacted emergency legislation at the start of the COVID-19 pandemic.

- March 2023: Nearly two dozen House Republicans co-sponsored legislation imposing stricter work requirements for able-bodied adults without children.

- June 1, 2023: The U.S. may run out of measures to pay its debt obligations, according to Treasury Secretary Janet Yellen.

Competing Narratives

1. Constitutional Interpretation:

Some lawmakers suggest that President Biden could bypass Congress and raise the debt limit under the 14th Amendment. Senate Budget Committee Chairman Sheldon Whitehouse has proposed this idea. However, this interpretation faces opposition from Republicans in the House and Senate, who warn against it and predict potential legal challenges.

Key Takeaways:

- The interpretation of the Constitution's 14th Amendment is a significant point of contention in the current debt ceiling standoff.

- The potential for legal challenges adds an additional layer of complexity to the situation.

2. Social Security Programs and Economic Recovery:

The debate around SNAP benefits and work requirements highlights the tension between social security programs and economic recovery. Emergency legislation enacted during the pandemic allowed all SNAP participants to receive maximum monthly benefits. Yet, nearly two dozen House Republicans are advocating for stricter work requirements for able-bodied adults without children.

Key Takeaways:

- The debate around social security benefits and economic recovery measures is a critical factor in the debt ceiling narrative.

- The struggle to balance economic recovery with social support measures is a significant theme in this crisis.

3. The Debt Ceiling and Default Risk:

The impasse over the debt ceiling between President Biden and House Speaker Kevin McCarthy could lead to a U.S. default.

- The White House and Republicans in Congress are currently at a stalemate over the debt limit.

- The failure to raise or suspend the debt limit could have severe consequences, including a potential default.

Narrative AI Analysis

Insights for Bias in U.S. Media

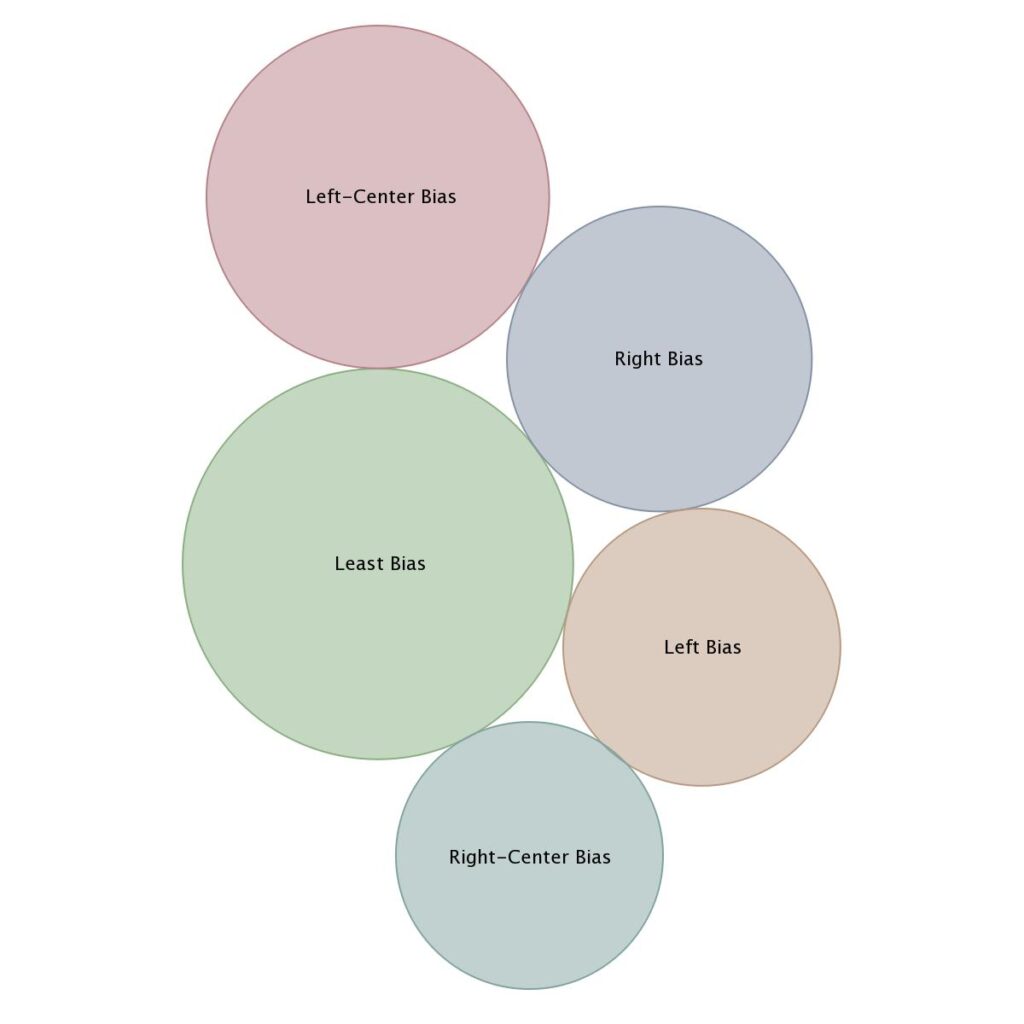

Coverage of the debt ceiling narrative shows the least bias, with 806 out of the 2,645 items categorized as such, followed by Left-Center and Right biases. Left and Right-Center biases are trailing.

- The narrative exhibits a significant amount of neutral coverage, suggesting that the issue is being treated as a matter of national importance, rather than a partisan debate.

- The Left-Center bias has a slight lead over the Right bias, indicating a lean towards the Democratic stance in the middle-ground coverage.

- The lowest coverage comes from the Left and Right-Center, suggesting less polarization in this issue than others.

Key Takeaways: While the issue of the debt ceiling is a matter of political contention, the bulk of the coverage appears to be relatively neutral, with a slight lean towards the Left-Center.

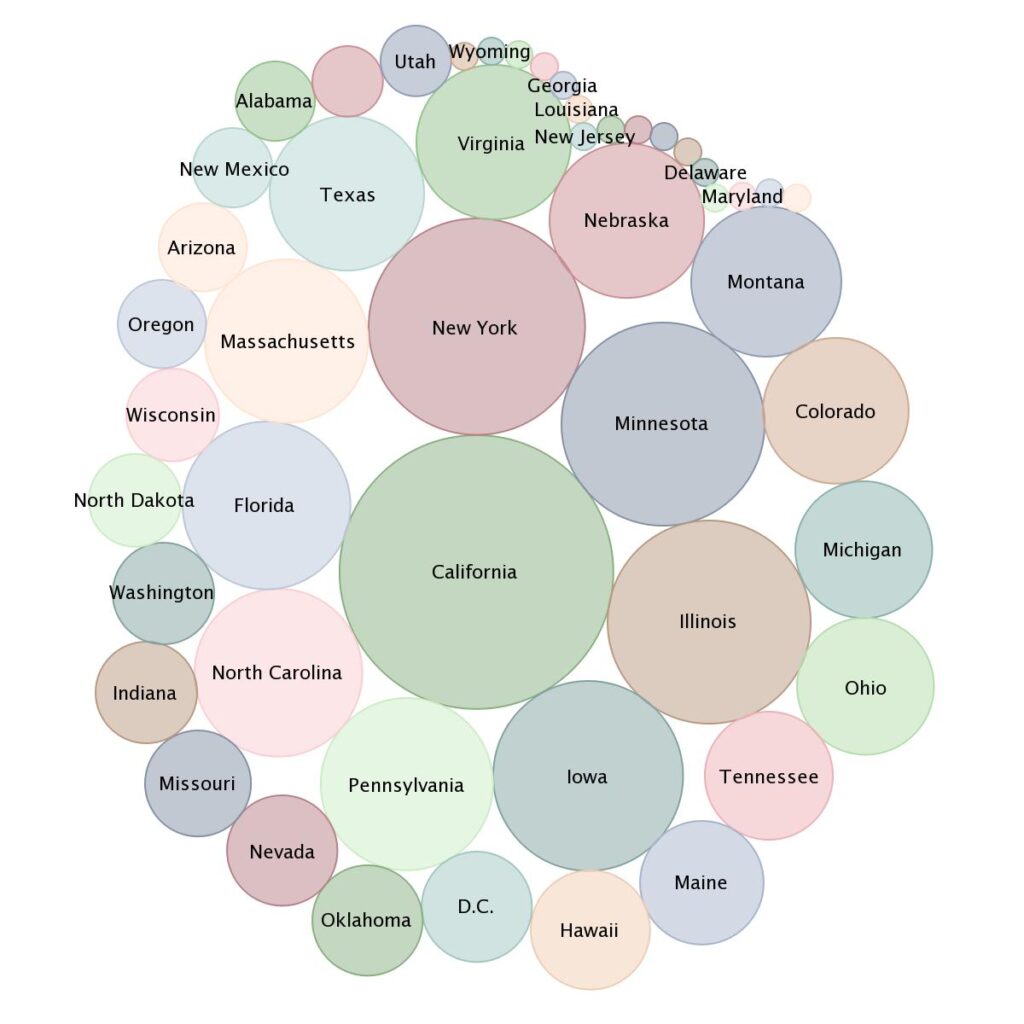

Insights for Amplification by State

California, New York, and Minnesota are leading in amplifying the debt ceiling narrative.

- California, being the most populous state, has the highest amplification, suggesting a high level of public and political interest in the state.

- New York and Minnesota follow, indicating significant regional interest in these states.

- The Southern states, like Florida and Texas, despite their large population, are at the lower end of the narrative amplification.

Key Takeaways: The debt ceiling narrative has significant regional variations, with coastal and Midwestern states appearing more engaged in the issue.

Most Amplified Outlets

The Washington Examiner has the most amplified narrative, followed by The Hill and the Washington Times.

- The Washington Examiner, a conservative news outlet, leads in coverage, suggesting a high degree of interest from the right-leaning audience.

- The Hill and the Washington Times follow, implying that the narrative is being driven by a mix of moderate and conservative outlets.

- Liberal outlets like CNN and MSNBC are further down the list, indicating less engagement from the left-leaning audience.

Regional Implications and Context

The regional implications of the debt ceiling impasse could be significant, with potential impacts on states' economies and public services. This could particularly affect states with higher levels of federal workers or those more reliant on federal funding.

- States with large populations of federal workers, such as California and Virginia, could face higher unemployment rates if a government shutdown occurs due to the debt ceiling crisis.

- States more dependent on federal funding, such as New Mexico and Mississippi, could see cuts to public services if the federal government defaults.

- States with significant military presence, like North Carolina and Texas, could face cuts to defense spending, impacting local economies.

Impact on International Relations

The debt ceiling impasse could have significant impacts on international relations, particularly around the U.S.'s credibility as a borrower and its standing in global financial markets.

- A U.S. default could shake global confidence in American financial stability, impacting international lending and borrowing rates.

- Countries heavily invested in U.S. debt, like China and Japan, may reassess their financial strategies, potentially leading to less favorable borrowing terms for the U.S. in the future.

- The impasse could impact the U.S.'s soft power, as it may be perceived as less able to manage its own financial affairs.

Future Considerations

Moving forward, the debt ceiling impasse could have lasting impacts on U.S. politics and policy, potentially prompting a reevaluation of the debt ceiling mechanism itself.

- The recurring crises surrounding the debt ceiling may prompt calls for a change to the debt ceiling mechanism, potentially leading to a shift in fiscal policy.

- The impasse could impact upcoming elections, with voters potentially penalizing parties they perceive as responsible for the crisis.

- The crisis may prompt a broader discussion around fiscal responsibility and the role of government spending, possibly leading to policy changes in these areas.

Note: Kudzu Narrative Intelligence briefs update every few hours. Very likely, the Narrative Analysis data visualization depicted in the graphic above will have changed as well.

Credits: Cover Photo by Alejandro Barba on Unsplash