On Thursday, the Department of Commerce released a report detailing the GDP estimate for the second fiscal quarter of 2022. Despite widespread forecasts of slight economic growth, the economy reportedly shrank by 0.9% in Q2. The second period of economic decline is commonly described as a technical recession. However, many prominent figures are downplaying what these numbers might mean for the economy. With 616 sources of U.S. Media presenting 6,965 unique narratives, the recession conversation is taking over.

A tough sell:

One topic that the media has covered heavily is those who have tried to quell recession fears. The hopeful words of some of the most important public figures have been circulated heavily in U.S. Media.

Treasury Secretary Janet Yellen was one of the first to speak up following the release of GDP numbers on Thursday. Her name was mentioned 225 times in U.S. Media. Following a list of the administration’s economic accomplishments, Yellen opposed the idea of recession. Instead, Yellen opted to say that the economy is in a state of “transition, not recession.”

Also attempting to assure Americans of the economic state is Joe Biden. The media paid attention to Joe Biden’s relaxed demeanor about the economic crisis. He was mentioned 540 times with the recession narrative on Thursday, July 28th alone. Citing low unemployment numbers among other economic indicators, Biden quipped, “that doesn’t sound like a recession to me.”

Federal Reserve chair Jerome Powell (1,294 mentions) has reflected the viewpoint of the Biden Administration, claiming that “too many areas of the economy that are performing too well.”

Despite these words of reassurance, the American public seems doubtful at best.

Not buying it:

In perhaps the clearest illustration of the division over what a recession is, Wikipedia was forced to freeze edits to its “recession” completely. Following Biden’s denial of a recession, Wikipedia users entered an “editing war” by repeatedly changing the website’s definition of “recession” to whatever they felt was more appropriate. In many ways, this Wikipedia chaos reflects how controversial the terminology of recession really is.

Additional data shows that most Americans express the same sort of conflict with the White House about whether the country is in a recession.

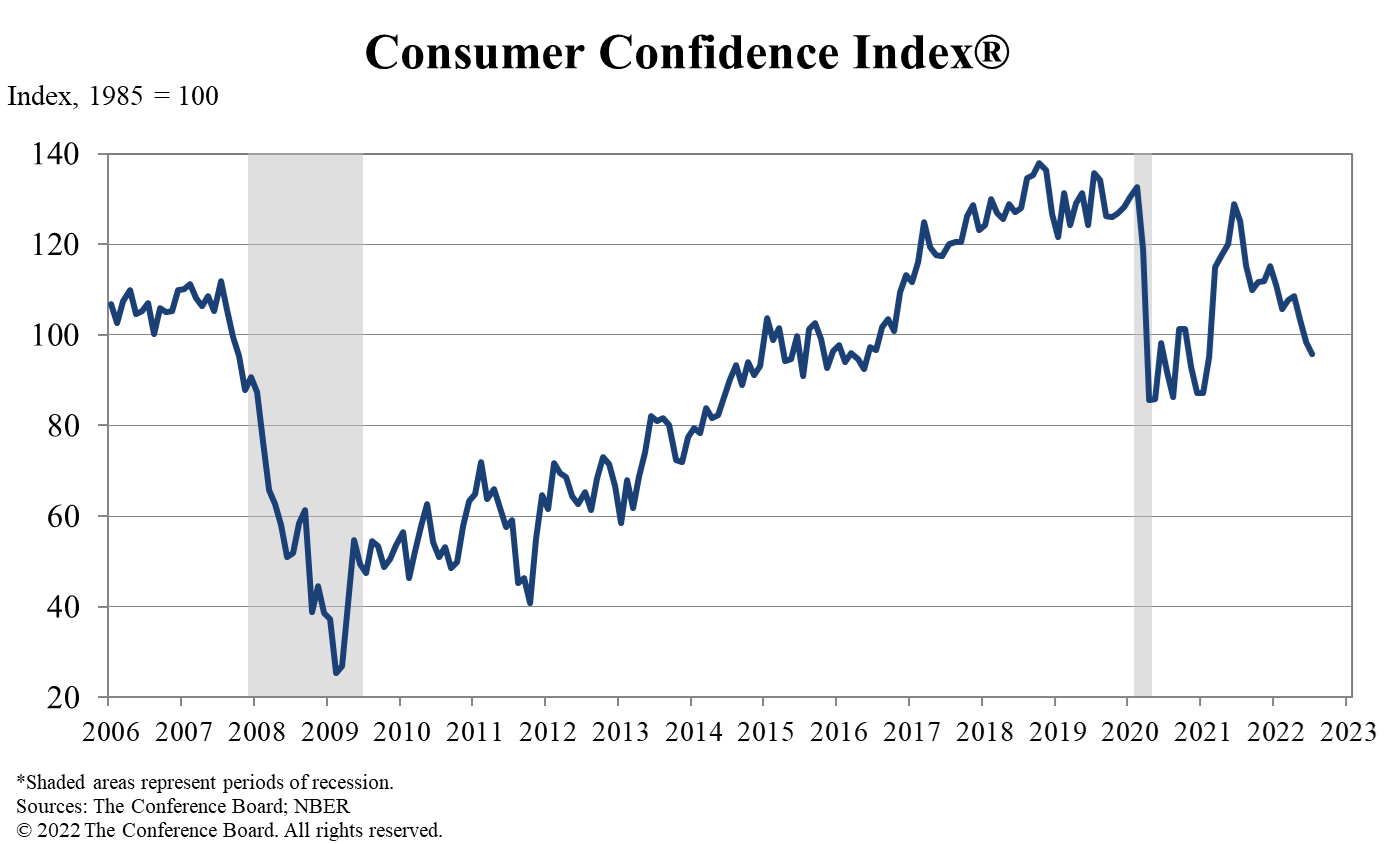

Current economic data shows that Americans are not very optimistic about the U.S. economy. The consumer confidence index is a prime example. The consumer confidence index is a measure of how consumers perceive their current financial situation. A clear indication of the current economic climate attitudes, this number has continued to fall. Declining for the third month in a row, the index is stooping dangerously close to pandemic levels.

When it comes to the specific question of recession, the hopes are not too much brighter. A recent IBD/TIPP Poll found that 58% of Americans believe we are in a recession. This poll came even before the release of the disappointing GDP estimate. While this isn’t entirely indicative of the state of the economy, it is not insignificant. Ritholtz Wealth CEO “Downtown” Josh Brown emphasizes that the idea of a recession can turn into a “self-fulfilling prophecy.” In this case, the fear of an economic downturn can impact consumer spending so much that a recession becomes a reality. Even if we aren’t officially in a recession, 58% of people spending money like we are will certainly not promote economic growth.

Additional trend data from U.S. Media and U.S. Journalists shows the concerns being covered alongside the recession.

The Issues:

Americans aren’t concerned about the economy for no reason. Narrative intelligence tracks which issues are being covered most heavily within the recession narrative.

Prices:

While Americans can sideline the many intricacies of the economy, one thing hits consumers at home: the price. U.S. Journalists covered spending, car prices, mortgage rates, and price premiums as leading topics.

Rate hike:

The media has also reflected concerns regarding the interest rate hike (2,139 mentions). The Federal Reserve raised its benchmark interest rates by 75 basis points last Wednesday in a move that intends to “cool down” the economy and, therefore, inflation. Many fear this rate hike will push an already struggling economy into a recession to combat long-term inflation.

Labor market:

The labor market is unique to the narrative. While price raises and rate hikes are hurting Americans, the labor market has been a relative stronghold. The White House touts job creation (1,400 mentions) and unemployment (1,366 mentions) as a recession “buffer”.

While the media does not capture all of the issues Americans face, it controls the national dialogue. Prices, the rate hikes, and the labor market are some of the most heavily covered of many issues shaping the recession narrative.

Analysis:

Despite an administration that is comfortable with the recent GDP earnings, the fear of a recession continues to be overwhelming. Leaders who promote economic optimism are being covered by the media, but the opinions of the average American just don’t seem to line up. Narrative intelligence in U.S. Media gives a better understanding of the people and topics that are driving the conversation.