You may have noticed that GameStop is trending. You may not have thought of GameStop since you tried to sell your video games for beer money in college, and for the past few years, the struggling bricks-and-mortar video game retailer was headed the way of Blockbuster. Right now this floundering company is ground zero in a war between professional investors and hedge funds against “Reddit bros”.

In early January, GameStop was trading around $18. By market close yesterday, it had reached $364.15. There is passionate buzz around the stock due to a discussion on the Reddit forum Wall Street Bets. Rampant coverage by the media and social media intensified the situation. At least one hedge fund, Melvin Capital, that was betting the price of GameStop stock would fall (called "shorting") was crushed.

It's tempting for market professionals to write this off as "Reddit bros" flexing their collective conversational power. It would be smarter to view this as a cautionary tale of how savvy groups can co-opt social media to attack the financial establishment. Understand that short sellers have lost $5bn on GameStop this year, according to S3 Partners.

There's no question that Twitter and Facebook have changed politics. Now Reddit may be changing Wall Street in the same way. The server of the r/WallStreetBets message board used by many of the retail investors has meanwhile been banned by the chat app Discord for “hate speech” and “glorifying violence”. On Thursday morning, stock-trading app, Robinhood announced that it would temporarily block investors from purchasing or trading companies that have had ginormous rallies in the last few days. These include GameStop, AMC, BlackBerry, Bed Bath & Beyond, and Nokia.

How are hedge funds responding? They are attempting to build their own scrapers or find intelligence platforms that can quickly pivot to start monitoring Reddit and, maybe more importantly, subreddits. "One data scientist at a fund told Insider they created a scraping tool this weekend to monitor tickers being discussed on the site to make sure their fund's short book isn't caught in the next 'YOLO' trade, parlance on the subreddit for a high-stakes wager, often involving stock options."

Our CEO, Joe Stradinger recently posted this: "The world’s narratives are no longer just playing out on traditional social media sites like Facebook and Twitter. Humans are tribal by nature and this is playing out as tribes begin to form, gather and converse on hundreds of platforms from Discord, Mewe, Reddit, and on and on.

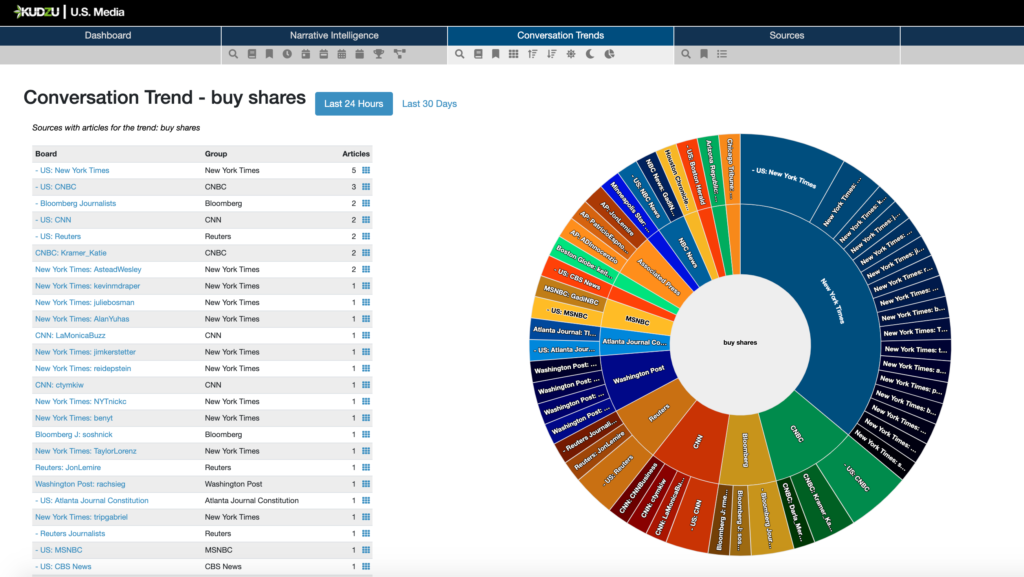

In order to truly understand conversations and the narratives, one must analyze all of these platforms. At EdgeTheory we have always said that the conversation is either an organization’s greatest asset or greatest liability. That is exactly what has played out over the last several days as #financialmarkets were literally turned upside down based on the online conversation around #hedgefunds, #daytraders, #gamestop, etc. The conversation was an asset for some and a huge liability for others."

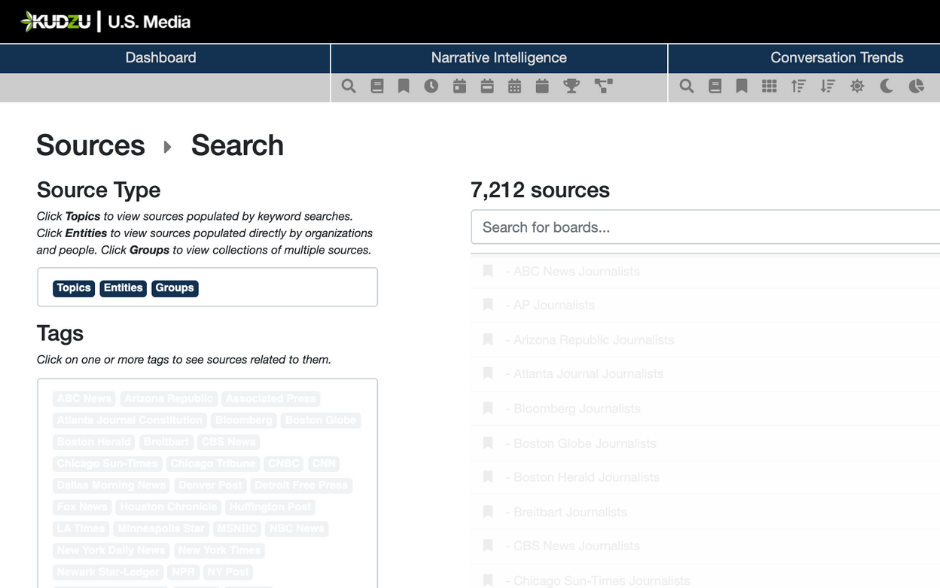

Narrative intelligence is more critical than ever. With it short sellers could have known about the Game Stop narrative before it even made its way out of Reddit. One thing is for sure: there are already narratives beginning to proliferate around the next GameStop.

Want to learn more about how to protect your organization or portfolio by listening and analyzing narrative intelligence and conversation trends from Reddit, subreddits, the media, and other platforms? Get in touch to discuss Kudzu solutions tailored to fit your needs. Contact us before your financial misstep starts trending.