On Friday of last week, regulators officially closed SVB (Silicon Valley Bank). SVB is a bank specializing in technology start-ups and small businesses in Silicon Valley. According to the New York Times, the bank received a large influx of cash over the past year from different customers and decided to keep a small amount of that cash in the bank while using the rest to buy long-term debt. This is a standard practice amongst banks similar to SVB, but they didn’t consider that the economy was packed with Covid stimulus money and that the Fed may hike interest rates to curb stimulus-induced inflation. This caused SVB to raise its own interest rates on loans, which resulted in many customers rapidly withdrawing their deposits. Thus, the bank had put itself in a position where it could not pay everyone their withdrawals.

At the end of last week, the FDIC took over the bank and began looking for a buyer. President Joe Biden has since announced that Congress had decided not to provide SVB with a government buyout. This decision is unlike the one made in 2008 during the last significant financial recession, where the government bailed out several large banks that were facing a collapse in the wake of the subprime mortgage crisis. In another surprising turn, the Biden administration also announced that all of SVB’s customers would be made whole and have access to their funds this Monday. The money necessary to finance this restitution is coming from a fund that banks already pay into for this exact reason, and not from taxpayers' dollars. This will allow these start-ups and small businesses to stay open and save thousands of jobs. This move comes on the heels of another New York bank collapse, and U.S. regulators are doing what they can to restore confidence in the U.S. banking system. This is all in hopes that people do not panic and start withdrawing their money from banks at the same time.

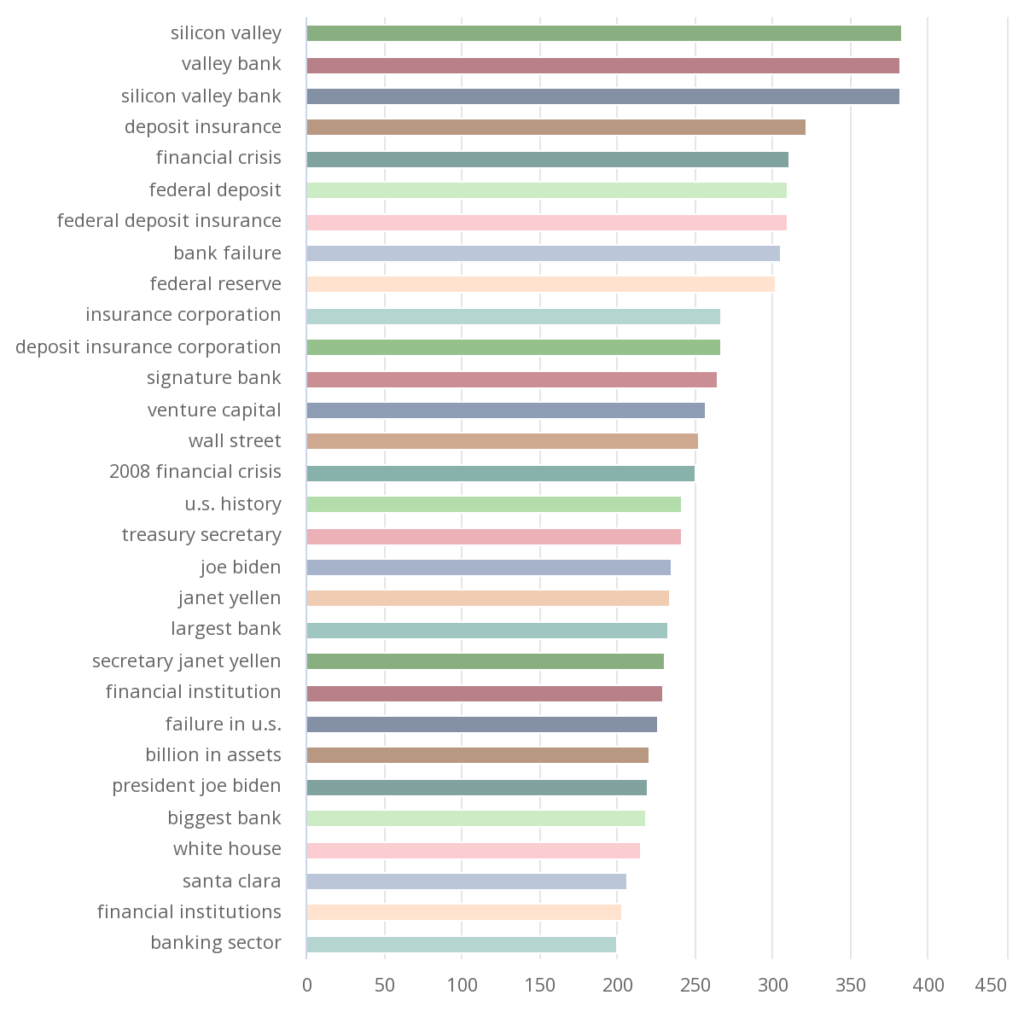

In this Kudzu Narrative Brief, we can take a deeper look into what the U.S. media is saying about the largest bank collapse since 2008.