Here is an overview of our Personal Debt Narrative Intelligence brief.

This Personal Debt narrative is driven by 298 sources in the U.S. Media module, amplifying 892 narrative items.

Today, our Narrative AI highlights rising credit card debt and economic challenges. These narratives connect themes of interest rate cuts, consumer debt management, and the impact of climate change on financial stability, highlighting the need for informed financial decisions amid increasing economic vulnerabilities.

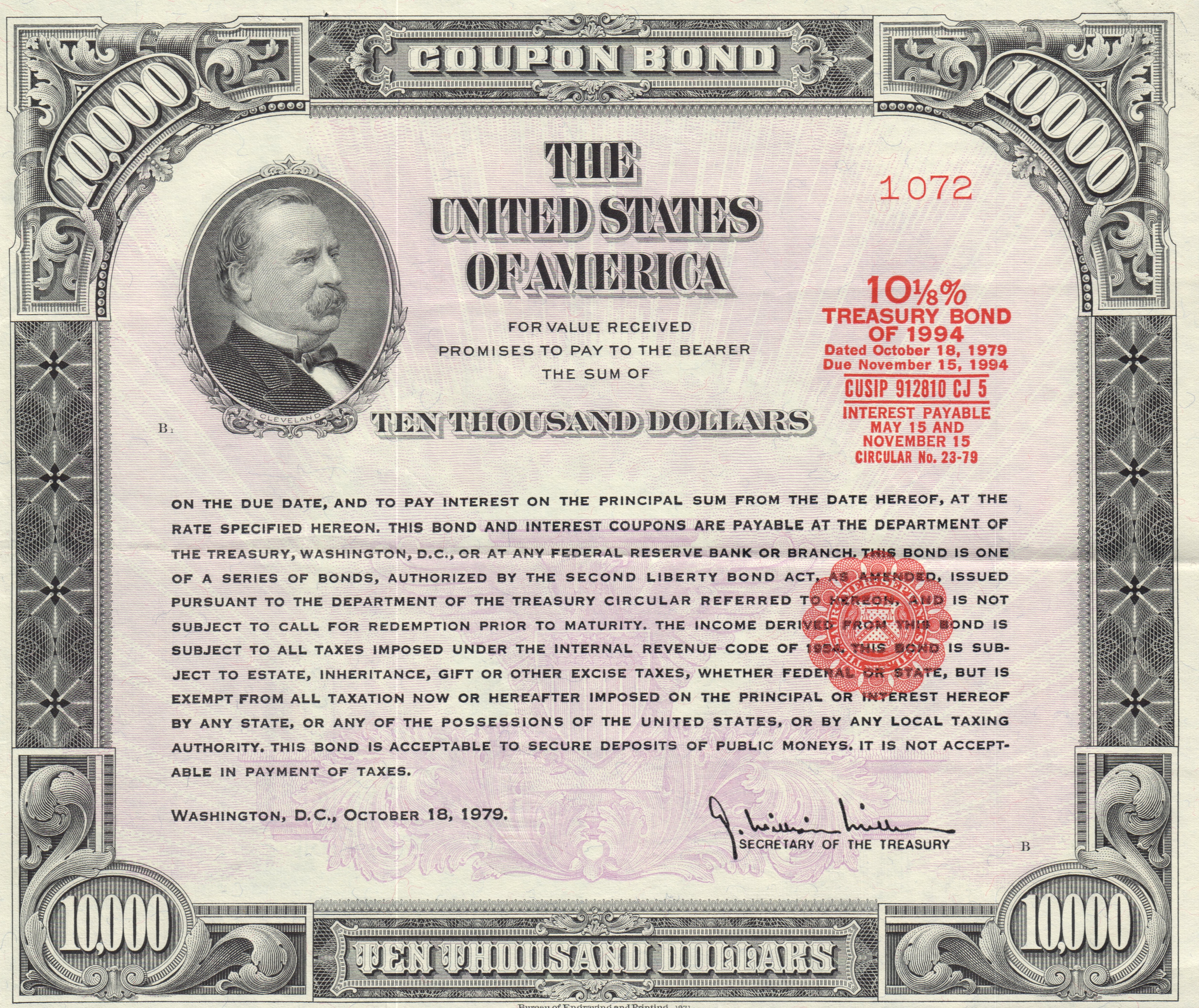

The recent decision by the Federal Reserve to cut interest rates by half a percentage point reflects a significant shift in economic strategy, moving from a focus on controlling inflation to addressing potential economic slowdown. This change is particularly relevant in the context of rising credit card debt, which has reached a staggering $1.14 trillion in the U.S. The average credit card debt in Pennsylvania, while lower than the national average, still indicates a concerning trend of financial strain among consumers, exacerbated by high interest rates and inflation.

Demographically, the burden of credit card debt is felt most acutely among older individuals and families with young children, who often face higher living costs and unexpected expenses. The economic implications are profound, as increased debt levels can lead to higher delinquency rates, particularly among lower-income earners. This situation poses risks not only to individual financial stability but also to broader economic growth.

Geographically, the impact of climate change, particularly through events like wildfires, adds another layer of complexity. The health consequences of wildfire smoke can lead to increased medical expenses and lost income, further straining household finances. This environmental issue intersects with economic stability, highlighting the need for comprehensive strategies that address both climate change and economic resilience.

Politically, the Fed's actions may influence market volatility and investor confidence, necessitating careful monitoring of economic indicators. The military and national security considerations are less direct but can be affected by economic stability, as a strong economy is crucial for maintaining national defense capabilities. Overall, the interplay of these factors underscores the importance of informed financial decision-making and proactive measures to mitigate debt burdens in an uncertain economic landscape.

Our Kudzu Narrative Intelligence brief auto-updates every few hours with fresh analysis:

Note: Kudzu Narrative Intelligence briefs update every few hours. Very likely, the Narrative Analysis above will have changed as well.

Image Credit for Article Header: Wikimedia Commons