Embroiled by the current bear market of the U.S. economy, the market for cryptocurrency has once again entered a “crypto winter”. Several crypto firms have already declared bankruptcy, and prospects for crypto’s recovery remains uncertain. Narrative intelligence briefs in U.S. Media and Cryptocurrency Media reveal the key differences between how each is handling the volatile situation of the crypto market.

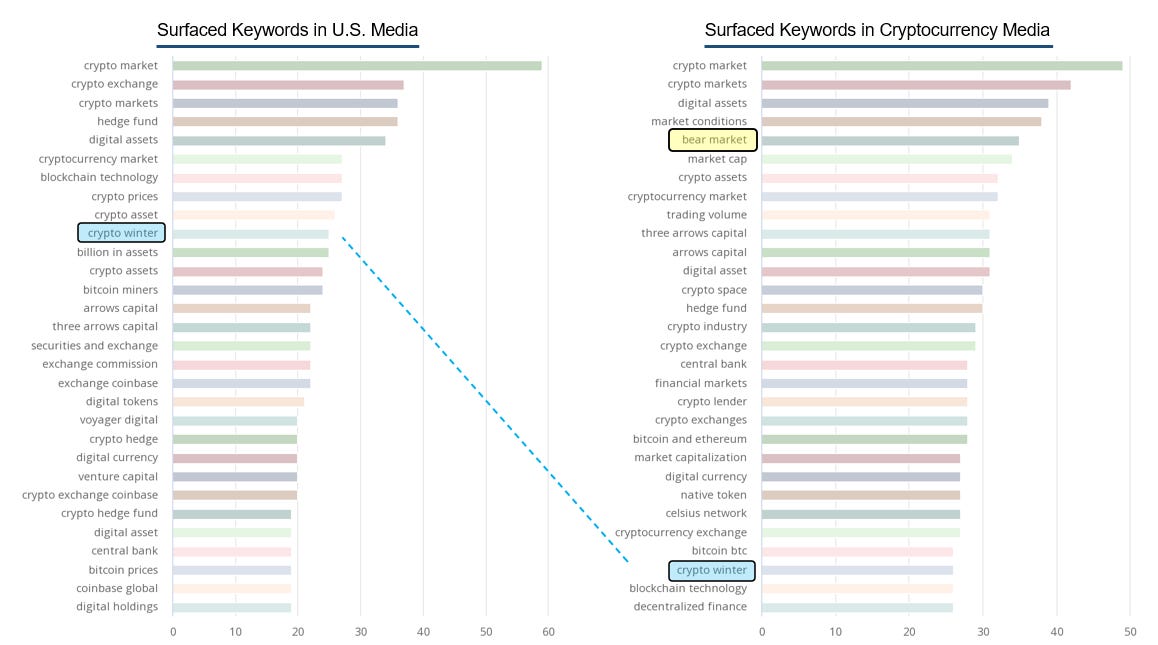

Surfaced keywords in each brief show the greatest contrast between each type of media’s coverage. In the figure below, the left-hand chart lists the surfaced keywords by number of sources for the U.S. Media brief, while the right-hand chart displays the keywords for the Cryptocurrency Media brief. Comparing these two charts reveals two significant differences.

Blaming the Bear Market or Crying Crypto Winter

Highlighted in yellow, “bear market” surfaced in the top five keywords in cryptocurrency media, yet “bear market” does not appear on the corresponding list for U.S. media. On the other hand, “crypto winter,” highlighted in blue, appears in the the top ten keywords of U.S. media, but in cryptocurrency media, “crypto winter” barely falls within the limits of the thirty top keywords. The keyword dynamics of each term in both briefs further emphasizes this difference, as shown in the figure below.

By number of mentions, “crypto winter” takes second place in the U.S. Media brief, and “bear market” appears later down the list in ninth place. Inversely, “bear market” ranks second place in the Cryptocurrency Media brief, and “crypto winter” correspondingly surfaces seventh place.

Both “bear market” and “crypto winter” follow the same general trend in the cryptocurrency brief, but “crypto winter” shows a considerable spike in U.S. media on July 14th. On July 14th, Forbes released an article on the impending crypto winter for the cryptocurrency market, further amplifying its warnings about the crypto winter. In the U.S. Media brief, crypto winter has been mentioned 166 times, 61 one which from Forbes.

Crypto Bankruptcies and Hedge Fund Collapse

From the initial figure of surface keywords, one other key point can be distilled. Highlighted in purple below, the bankruptcy of Three Arrows Capital, a crypto hedge fund based in Singapore, caused the bankruptcy of Voyager Digital and generating significant press. Celsius Network, also highlighted in purple, recently filed bankruptcy as well. Comparing the two charts, both types of media cover these incidents in a similar frequency.

On the other hand, “hedge fund,” highlighted in green, ranks significantly higher in the keywords of U.S. media than in cryptocurrency media. “Hedge fund” appears more often across sources in the U.S. Media brief than “bear market” does in the Cryptocurrency Media brief, and a second similar term, “crypto hedge fund,” appears in U.S. media as well. The frequency of “hedge fund” across U.S. media suggests the impact of a crypto hedge fund’s collapse on the crypto markets concerns U.S. media sources more than cryptocurrency-focused sources.

Two key points emerge from this comparison:

As the crypto market continues to carve its uncertain path, both narrative intelligence briefs will continue to update their coverage.